The Giving USA 2019 report by the Giving USA Foundation and the University of Indiana Lilly Family School of Philanthropy has just come out. The good news? American individuals, bequests, foundations and corporations gave $427 billion to U.S. charities in 2018, according to Giving USA 2019: The Annual Report on Philanthropy for the Year 2018. We Americans are very generous to our churches and charities. In good times, we give a bit over 2 percent of our national GDP to charities. The bad news? 2018 was a down year. Adjusted for inflation, total giving declined 1.7 percent.

Frankly, we have been expecting this news ever since the U.S. tax overhaul went into effect in early 2018. All is not lost, though. At TechSoup, we of course follow technology closely, and we have some ideas on how you can use digital fundraising techniques and tools to thrive in recessionary philanthropic times.

Why the Downturn?

The fact is that, according to the Giving USA 2019 report, we've had a pretty steady growth trend in charitable giving since 2009. It's been a very good run. From 2009 to 2018, charitable giving went up 33 percent according to Giving USA. Giving in 2017 was at the highest level ever, so even though giving is starting to decrease, there remain plenty of charitable donations.

In early 2018, the new U.S. tax overhaul, officially called the Tax Cuts and Jobs Act, went into effect. The stock market decline in late 2018 during the end-of-year giving season may have also had a dampening effect despite the fact that the overall U.S. economy was relatively strong in 2018. The Giving USA 2019 report says:

"One important shift in the 2018 giving landscape is the drop in the number of individuals and households who itemize various types of deductions on their tax returns. This shift came in response to the federal tax policy change that doubled the standard deduction. More than 45 million households itemized deductions in 2016. Numerous studies suggest that number may have dropped to approximately 16 to 20 million households in 2018, reducing an incentive for charitable giving. The full impact remains to be seen."

Individual Donations

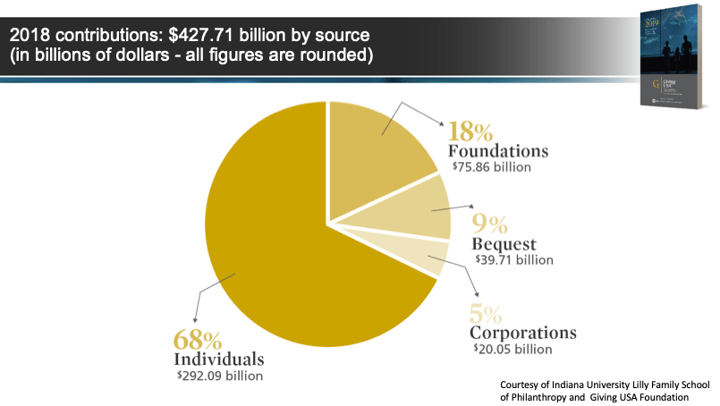

One of the biggest declines was giving by individuals. This decreased 3.4 percent (adjusted for inflation) in 2018. Of course individuals have long been and still comprise the majority of charitable donors. In 2017, individual donations accounted for 70 percent of charitable giving. In 2018, it came down to 68 percent. This trend is huge. This is the first time giving by individuals has fallen below 70 percent of overall giving since at least 1954.

Foundation and Corporate Grants

Foundations increased their grantmaking 1 percent in 2018, but between 2017 and 2018, inflation-adjusted giving to foundations declined 9.1 percent, which is a considerable drop. If this trend holds, there may well be a decrease in foundation giving in the near future. Family foundations still provide the bulk of foundation grants.

Corporations have been giving less to charities in the last few years. The cumulative change in inflation-adjusted giving by corporations between 2016 and 2018 is down 1.2 percent. Corporate giving has been steady at around 5 percent over the years. Corporate giving generally follows the trend of pretax profits, which fell 0.2 percent in 2018.

Hardest Hit Charities

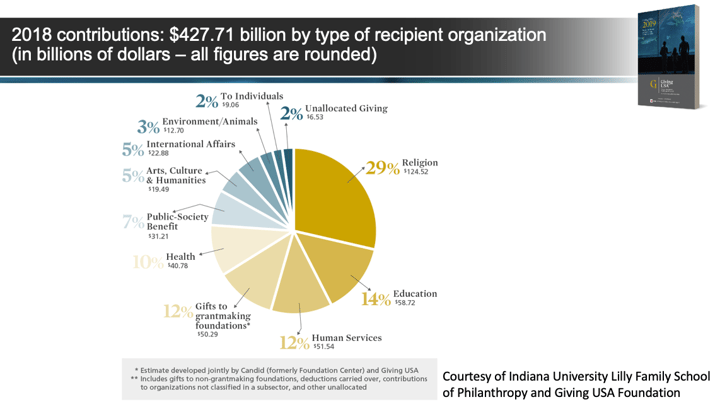

Decreases in giving in 2018 were borne by U.S. charities that have traditionally received the most donations. These include churches and religious organizations, education, human services, health, public-society benefit organizations, gifts to grantmaking foundations, and arts, culture, and humanities. Here are the 2018 drops in giving to these charities adjusted for inflation:

- Contributions to grantmaking foundations decreased 9.1 percent.

- Giving to public-society benefit organizations declined 6.0 percent.

- Contributions to churches and religious organizations decreased 3.9 percent.

- Contributions to education organizations decreased 3.7 percent.

- Contributions to human services decreased 2.7 percent.

- Contributions to health decreased 2.3 percent.

- Contributions to arts, culture, and humanities organizations decreased 2.1 percent

Some Bright Spots

- Contributions to international affairs organizations increased 7.0 percent in 2018

- Contributions to environment and animal welfare organizations grew 1.2 percent in 2018.

What Can You Do About This?

I had the opportunity about a year ago to look into this with the great fundraising expert Michael Stein. In our blog post, Charitable Giving Expected to Plunge: How Nonprofits Can Survive, we provided some practical tips that are still very relevant. Long story short, it's time to double down on digital fundraising. Here is what we recommend.

"Your charity may want to consider staffing up in critical areas of fundraising. Staffing up would be especially helpful in higher revenue opportunities. These options include growing mid-level giving programs, using wealth screening services to identify donation opportunities, investing in a higher performing donor management platform, and piloting ways to move donors up the ladder of engagement. Many of these options may require different staffing configurations or partnerships with agencies that can help charities achieve these goals."

Some Additional Practical Suggestions

- Survey your existing donors and nondonors to determine their propensity to donate given changes in the new tax law.

- Focus your organization's fundraising efforts on diversifying giving options. These might include expanding choices for giving. Here are some examples:

- Sustainer giving, in which donors contribute through automatic deductions on a monthly or quarterly basis.

- Workplace matching, in which companies match employee donations.

- "In honor of" sponsorship opportunities such as naming rights for special programs.

- Legacy giving, in which supporters put your organization in their will or living trust.

- Mid-level giving programs with membership benefits such as coupons and discount codes, printed calendars, t-shirts, and other branded items. These are donation opportunities above small donations and below major giving.

- Make sure to continue strong engagement with your existing donors, especially your small donors, because many will already not be itemizers and therefore will be a strong base for your fundraising revenue.

Giving USA's practical advice is that "donors in the mid-range of a given organization's gift pyramid may be impacted the most by the Tax Cut and Jobs Act. Extending your relationship-building and prospect management system to donors below your current major gift level makes good sense in this changing environment."

A Final Thought

Have a look at the current Giving USA report. The full report costs $99, but it is well worth the investment. We have provided some highlights of it, but the full report is 480 pages with lots of detail on the current state of philanthropic giving in each major category of charities. It is a very good time to study and understand the current state of philanthropic giving.

Additional Resource

TechSoup donor partner ClickTime has published an infographic based on information from the Giving USA report.