Year-end tax statements provide donors with a convenient summary of their charitable contributions. They also offer your organization an additional opportunity to express its appreciation. We know how busy fundraisers are at the end of the year, so we've put together these simple guidelines for you. And to make things even simpler, we included an example to help you create effective year-end tax statements.

Who Needs to Send Year-End Statements?

It's important to acknowledge donations as they come in throughout the year. Even so, you should also consider sending year-end tax statements because they are such a handy tool for donors as they complete their taxes. Instead of searching for each acknowledgment that your organization has sent over the year, donors can find all the information they need in one document. Your supporters will appreciate this convenience.

Tax Requirements

Only donations made to 501(c)(3) organizations are tax-exempt, so you need to be a 501(c)(3) to issue tax-deductible acknowledgments. The IRS requires that you acknowledge any single donation of $250 or more, although we recommend acknowledging donations of all sizes. You should include the following information:

- Name of your organization

- Dollar amount of cash contributions (it's a good idea to include the date of each gift)

- Description (but not value) of noncash contributions

- Statement of which portion of the gift is tax-deductible, and for the nondeductible portion, a description and good-faith estimate of any goods and services you provided

Source: IRS, Charitable Contributions — Written Acknowledgments

Year-End Statements Should Be Professional and Accurate

The look of your year-end statements needs to align with the other communications you send throughout the year. Include contact information in case your donors have questions. Proofread your template, too. Typos or spelling errors look unprofessional and may cause your donors to question the accuracy of your records.

Provide Details for Gifts Received over the Past Calendar Year

Remember that your donors may be using these statements for tax purposes. This means that even if your organization's fiscal year starts on July 1, donors will need the information for the gifts they've made throughout the calendar year.

In your letter, include the date and amount for financial contributions and list the donor's total giving amount for the year.

For in-kind gifts, you may include descriptions of items but not their values. The IRS advises not to include values since it's up to the donor to determine the value of in-kind contributions.

Include a Message of Gratitude, but Don't Ask for Another Gift

Keep your text brief to allow room for gift details, but do include a message of thanks to reinforce your organization's gratitude for the donor's support over the year.

Avoid the temptation to include an request for another gift, though. The year-end statement should not ask donors to make an additional gift.

Test Out Your Statements in Advance

This is a big one! Don't wait until the last minute to generate your statements. Make a point to test your template in advance to make sure the formatting works as you expect. If it doesn't, you've allowed yourself time to make adjustments.

Remember that once all the gift details are merged, they may take up several lines. Leave room to accommodate those lines. When you test your template, you may find you need to trim the content of your letter. That's very common, and it's easy to resolve when you're not under a time crunch.

Once you've tested your template, plan to generate and print your letters at least a few days before you want to get them in the mail. That way, you have time to address any unexpected issues that may arise, whether it's another formatting issue you didn't notice before or a printer jam. The more time you allow yourself, the less stress you'll be under.

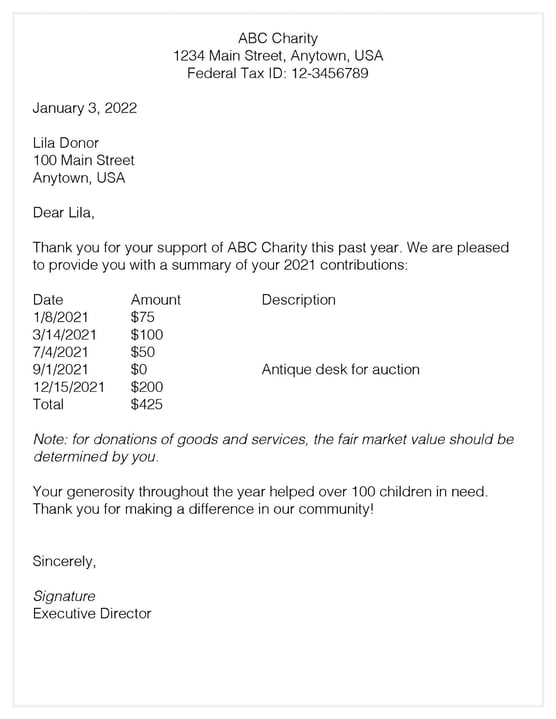

Example Statement

Here's an example of a year-end tax statement to help get you started. Download this letter as a PDF file.

Conclusion

Your donors will appreciate a timely, accurate giving summary. Sending year-end tax statements is a good way to close out the past year and start the new year strong.

Using a donor management system like Little Green Light, available at a discount to nonprofits through TechSoup, makes creating year-end statements a breeze. Learn more about how Little Green Light can help you manage your nonprofit's fundraising efforts by joining a free demo.

About the Author

Virginia works on the customer support team at Little Green Light. She has over 15 years of fundraising experience and continues to be active in development as she fundraises for Alamo Rescue Friends, a nonprofit dog rescue organization she founded in 2010. Virginia loves sharing practical ways for fundraisers to be more efficient and effective in their work, no matter how much experience they have or how big or small their organization is.

Additional Resources

- Enroll in TechSoup Courses' Fundraising Software Seminar Series.

- Get Tips for Acknowledging Sponsorship Gifts.

- Read about Budgeting for CRM: 4 Steps to Finding the Right System for Your Nonprofit.

- See a webinar on Why Nonprofits Must Optimize the Year-End Fundraising Experience.

Top photo: Shutterstock